Three ways to lower your taxable estate:

The financial planning cycle is an all-encompassing process that includes Investment planning, Insurance Planning, Tax Planning and Estate Planning among other areas. In one form or another your investment planning affects your estate planning which affects your tax planning which affects your insurance planning. Clients tend to think about these areas separately. Clients tend to think in terms of going to their Lawyer for their estate planning, their financial planner for their investment planning, their CPA for their tax planning and their insurance person for their insurance. A good financial planner will be able to direct clients to the professional who makes the most sense for their situation, but a financial planner can be viewed as the Quarterback for this process. Financial advisors who provide comprehensive financial planning services need to identify areas of a client’s financial picture that require more attention and in-depth analysis. Such is the case for clients looking to lower their taxable estate. These clients will certainly need the help of the financial planner, the insurance sales-woman, the CPA and the Attorney at all once. Knowing which professional to employ could have a significant affect on your assets. Without further ado, here are three ways you can lower your taxable estate:

Gifting Money to your Children and Grandchildren:

Current tax laws allow you to give away $14,000 per year to anyone you would like. However, most people aren’t interested in giving their money away to just anyone. A majority of clients will leverage the tax code to gift money to their children and grandchildren. Whether through cash or investment vehicles such as 529 plans, a parent can gift money to as many people as they would like for as many years as they would like. If your adult child is married, you can double the $14,000 and give $14,000 per year tax free to your children. If both Mom and Dad are giving money away, you can double that number again to $56,000 if giving to both the Adult child and the spouse. $56,000 might not be a large enough amount of money on it’s own to make a difference, but over a ten year period of time, that is $560,000. If you have another married child, over a ten year period of time you and your spouse can give away over $1,000,000.

Upfront gifting to a 529 plan:

529 plans offer a special feature that allow you to gift 5 years of assets all at once. Using the numbers from above for planning for one child’s education, you can upfront gift up to $140,000 for a married couple. For a single individual, again the gift amount is $14,000 per year multiplied by five and you get a $70,000 upfront gift to your child’s 529 account. Assuming you and your spouse have three grandchildren you’d like to help pay for college, that’s $420,000 you can eliminate from your estate in one year. Now we are talking significant assets being eliminated from your taxable estate. The cherry on top for this option is you are able to deduct the contributions to the 529 plan from your state taxes. With a tax rate of 5% in Illinois, contributions to a 529 plan could be a considerable deduction to consider. There are some caveats if you pass away before the 5 year period is over. We recommend you work with us and your CPA to understand the full ramifications of this option.

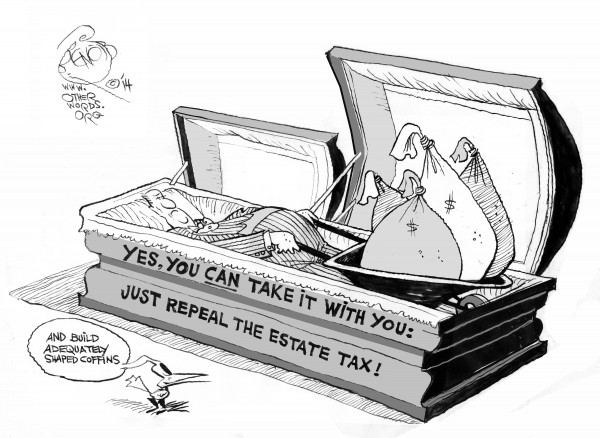

Establishing an Irrevocable Life Insurance Trust:

Establishing an Irrevocable Life Insurance Trust (ILIT) will require the help of an Estate Planning Attorney. An ILIT can be used to purchase a life insurance policy or transfer the ownership of an existing policy to the ILIT. The first word of this product/strategy is Irrevocable. That’s an important word. When you transfer assets into an ILIT, you lose control of managing those assets and making changes to the assets. By assigning the assets to the ILIT, you are saying “This money no longer belongs to me”. ILIT’s allow you to pass a significant sum of money to the next generation and avoid estate taxes. After the life insurance is purchased or transferred, the trust becomes the beneficiary of the policy. Upon your death, the life insurance proceeds are paid out and held in trust for the trustees of the trust. For more information, we recommend you talk with us an estate planning attorney.

There are many other ways financial professionals work to lower your estate tax liability. These are just three ideas to help you on your journey. For more ways to lower your estate tax liability, please call us at 847-290-0753. You may email me at jose@wisdominvestments.com.

Jose Cuevas

Vice President

Wisdom Investments

jose@wisdominvestments.com

http://www.wisdominvestments.com

847-290-0753